snohomish property tax rate

Whether you are already a resident or just considering moving to Snohomish County to live or invest in real estate estimate local. This means that the average homeowner in.

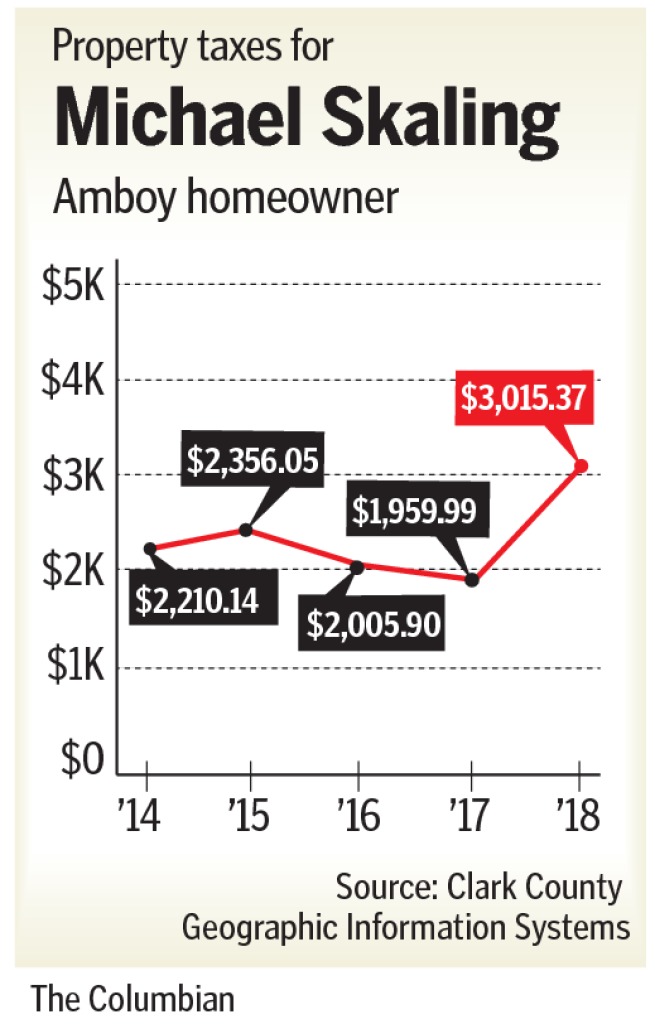

Clark County Homeowners Take A Hit As Property Taxes Pile Up The Columbian

Snohomish WA 98291-1589 Utility Payments PO.

. Search Any Address 2. Property taxes have increased in recent years but these increases have primarily been the result of new voter-approved levies to. The average effective property tax rate in Snohomish County is 119 which is nearly double the state average of 064.

For a reasonable fee they will accept monthly payments and pay your tax bills when due. The countys average effective tax rate is 119. Be Your Own Property Detective.

For comparison the median home value in Snohomish County is. When summed up the property tax burden all. Search For Title Tax Pre-Foreclosure Info Today.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600. Explore important tax information of Snohomish.

Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property tax rate. Ad Receive Snohomish County Property Records by Just Entering an Address.

Ad Download Avalara rate tables each month or find rates with the sales tax rate calculator. Box 1589 Snohomish WA 98291-1589. Learn all about Snohomish County real estate tax.

The average Snohomish County. See Property Records Tax Titles Owner Info More. Snohomish Countys average tax rate is 089 of assessed home values which is well below the national average of 11.

ASSESSED VALUES LEVY RATES TAXES Regular Value includes values of property subject to regular non-voter approved levies and Excess Value includes values subject to excess voter. The tax rate is 1200 per 1000 of assessed value. Snohomish County collects on average 089 of a propertys.

What is the property tax rate in Snohomish County. Contact Evergreen Note Servicing online by clicking here or by phone at 253-848-5678. How Much Are Snohomish County Property Taxes.

In 2021 a senior with a home worth 100000 will only pay 20000 in property taxes. MS 510 Everett WA 98201-4046 Ph. Property class Market value Assessment value Total tax rate Property tax.

Find Snohomish County Online Property Taxes Info From 2022. If you have questions you can reach out to our staff via phone email and through regular mail as well as visit our customer service center on the 1st floor of the Administration East Building on. In our oversight role we conduct reviews of county processes and.

The amount of property taxes you will pay in Snohomish County will depend on the assessed value of your property. Snohomish and every other in-county public taxing unit can now calculate needed tax rates since market value totals have been determined. Levy Division Email the Levy Division 3000 Rockefeller Ave.

The Department of Revenue oversees the administration of property taxes at state and local levels. Single Family Residence - Detached.

News Flash Snohomish County Wa Civicengage

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

Snohomish County Property Values Increasing Rapidly King5 Com

Washington Sales Tax Guide For Businesses

Washington Property Tax Calculator Smartasset

Snohomish County Property Tax Exemptions Everett Helplink

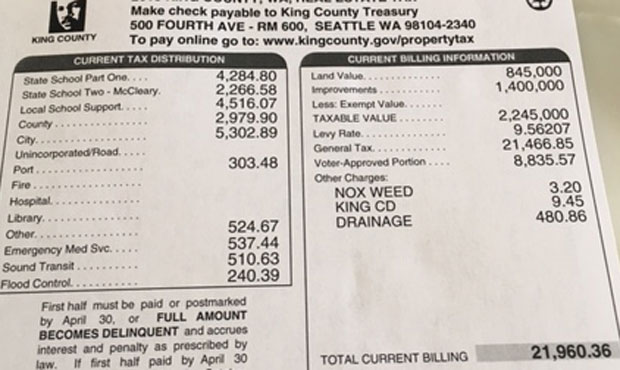

King County Taxes May Force 38 Year Capitol Hill Neighbor Out Of Town Mynorthwest Com

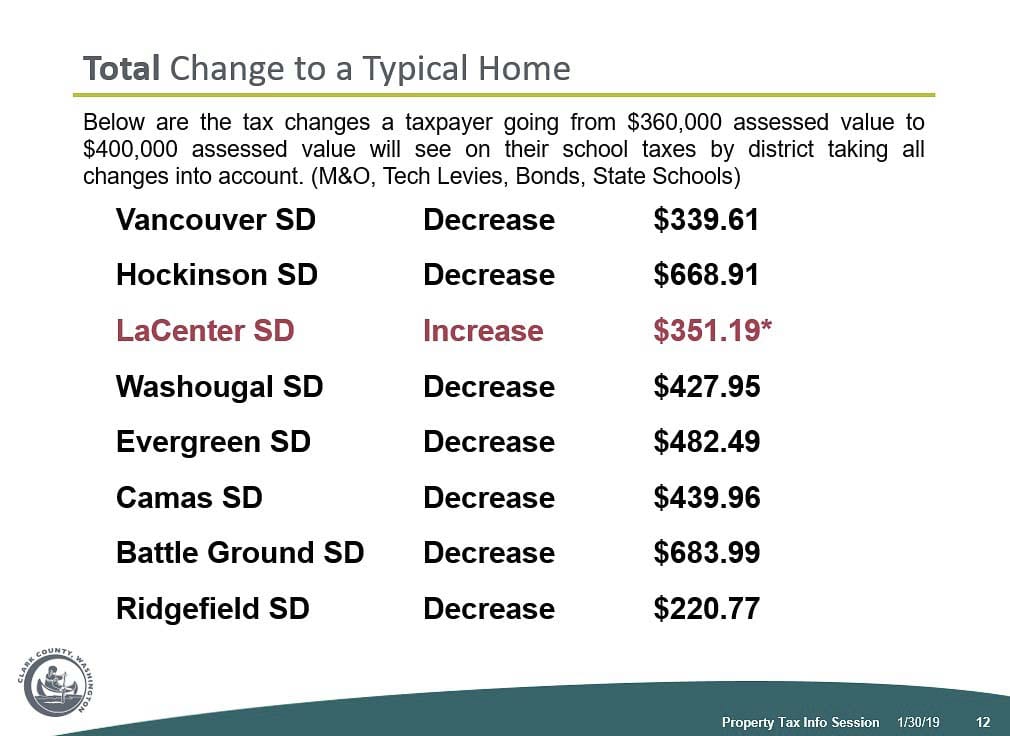

Property Taxes Explained Klickitat County Wa

King County Wa Property Tax Calculator Smartasset

Mrsc Property Tax In Washington State

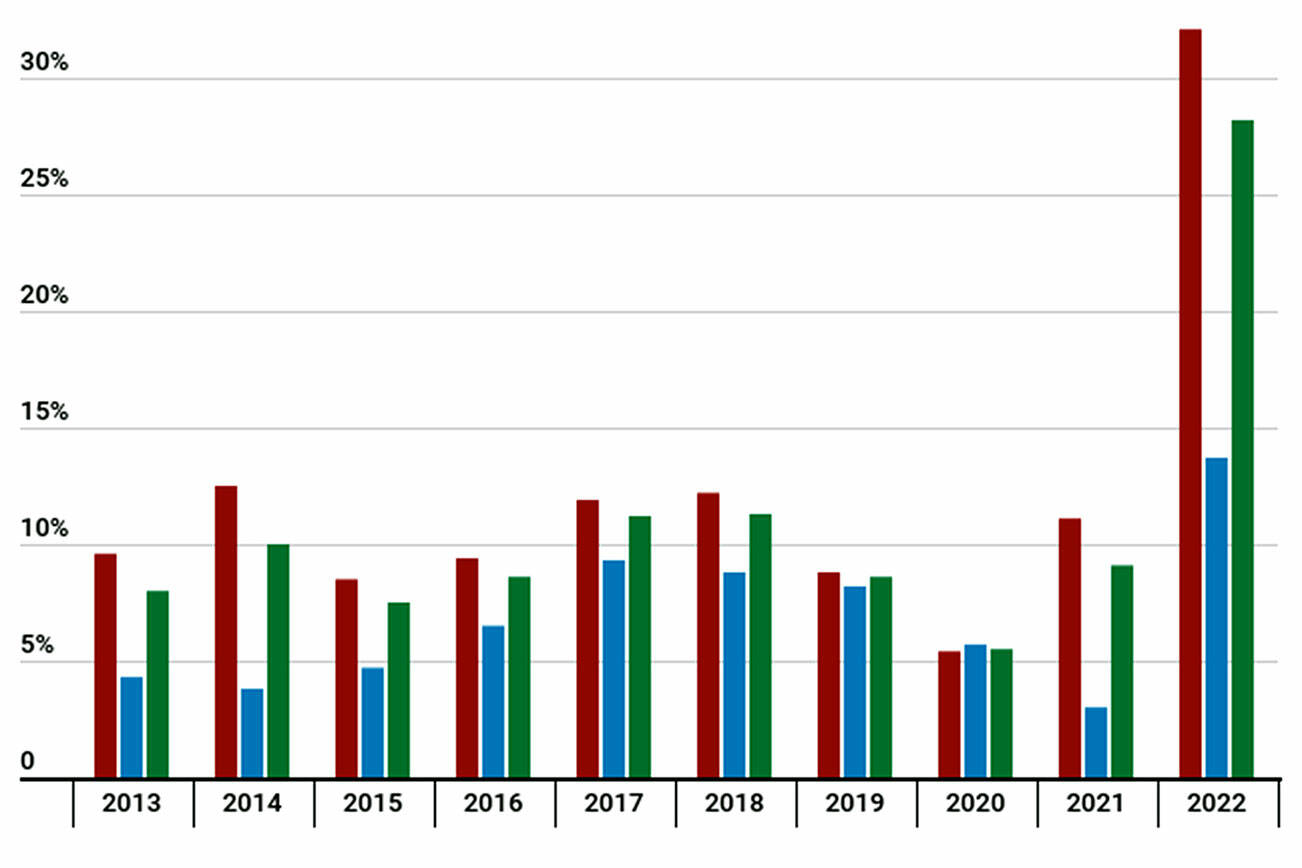

Property Values Soar 32 In Snohomish County Due To Hot Housing Market Heraldnet Com

Taxes And Incentives Everett Wa Official Website

What S Happening With Property Taxes In 2019 Clarkcountytoday Com

The Snohomish County Washington Local Sales Tax Rate Is A Minimum Of 6 5

Spokane Co To See Highest Property Tax Increase In Its History Krem Com

Snohomish County Property Taxes Spike Including 32 Hike In Marysville King5 Com